After an extended winter break thanks to the men’s football FIFA World Cup, Formula 1 roars back into action this weekend with the Bahrain Grand Prix, and fans have a plethora of ways to enjoy the action.

23 races take Formula 1 from Bahrain on March 5th through to Abu Dhabi on November 26th, with twists and turns guaranteed. Familiar venues such as Suzuka, Silverstone and Spa combine with newer venues such as Las Vegas, Miami and Zandvoort, giving fans a mixture of the new world and old throughout 2023.

From a broadcasting perspective, the landscape is increasingly fierce for content creators who want to stand out from the chasing pack. There are multiple options for fans consuming the content to choose from across live and highlights, video, and audio, and online or in the traditional newspaper format.

So, what is returning, what has changed over the hibernation period, and who are new kids on the block? Motorsport Broadcasting takes an in-depth look…

Channel 4 to take F1’s in-house commentary

A new year means new graphics on the television front, with F1 promising some incremental changes for 2023.

Speaking recently to SVG Europe, F1’s director of broadcast and media Dean Locke highlighted that fans will see six to eight live helmet cameras during a race weekend, audio upgrades, “new opening titles”, as well as the potential for biometric graphics later in the season, subject to FIA approval.

The sport has revamped their UK TV base, giving broadcasters the choice of hosting their offerings from an augmented reality (AR) studio at Biggin Hill. Locke says that F1 “will host various broadcasters’ commentary here as well, potentially.”

Fans in the UK can watch every session live on Sky Sports. Sky returns as the UK’s main F1 broadcaster, the pay television outlet entering their 12th season covering the series.

Sky will remain involved for the foreseeable future after agreeing a new rights deal late last year, taking them to the end of 2029 in the UK, and to the end of 2027 in multiple other European territories.

Their roster of motor sport programming expands beyond F1, and this year the broadcaster will air Formula Two, Formula Three, IndyCar, as well as the Indy NXT series for the first time.

The latter, previously branded Indy Lights, features current W Series champion Jamie Chadwick, Chadwick making the jump stateside. However, it is unclear whether W Series, minus Chadwick, will happen in 2023 owing to financial issues.

In the off-season, Sky have tweaked their on-air roster, with both Johnny Herbert and Paul di Resta departing. The rest of the team, including the commentary pairing of David Croft and Martin Brundle, remains the same.

Expect Nico Rosberg’s presence on Sky’s coverage to increase this year, as the FIA have relaxed its COVID-19 paddock protocols for 2023. F1 banned Rosberg from the paddock last season due to his COVID vaccination status.

As announced late last year when they renewed their deal with F1, Sky viewers can access all 20 on-board cameras this season in addition to a new ‘Battle Channel‘, giving Sky Q and Sky Glass subscribers a similar level of service to that overseas fans can receive via F1 TV Pro.

All details for Sky Sports F1 unless stated.

Friday 3rd March

11:00 to 13:00 – Practice 1 (also Sky Sports Main Event)

14:45 to 16:20 – Practice 2 (also Sky Sports Main Event)

17:00 to 18:00 – The F1 Show (also Sky Sports Main Event)Saturday 4th March

11:15 to 12:40 – Practice 3

14:10 to 16:30 – Qualifying (also Sky Sports Main Event from 15:00)

16:30 to 17:00 – Ted’s Qualifying Notebook

19:30 to 21:00 – Qualifying Highlights (Channel 4)Sunday 5th March

The full UK TV schedule for the 2023 Bahrain Grand Prix. Updated on 3rd March to reflect the shorter ‘Grand Prix Sunday’ length and longer ‘Race’ length for Sky F1.

13:30 to 18:30 – Race (also Sky Sports Main Event from 14:00 to 16:00)

=> 13:30 – Grand Prix Sunday

=> 14:30 – Race

=> 17:00 – Chequered Flag

=> 18:00 – Ted’s Notebook

21:00 to 23:30 – Race Highlights (Channel 4)

Channel 4’s free-to-air highlights package continues this season, with highlights of every race, as well as live coverage of the Silverstone weekend, airing on their main linear outlet.

Their coverage features a change which appears minor to begin with, but is significant underneath the surface. Alex Jacques remains Channel 4’s F1 lead commentator, however Jacques is no longer part of the core Channel 4 team. Confused?

Jacques has moved back to F1’s in-house team in the off-season, and will commentate on every race for F1’s streaming service, F1 TV Pro.

Instead of producing their own bespoke commentary, Motorsport Broadcasting can confirm that Channel 4 will take F1’s in-house commentary this year, Jacques alongside a team that includes ex-IndyCar racer James Hinchcliffe, Jolyon Palmer, and Channel 4 analyst David Coulthard.

The look and feel of Channel 4’s pre- and post-race programming stays the same. For Bahrain, Steve Jones will present alongside Coulthard, Mark Webber, Alice Powell, and Ariana Bravo, while Lee McKenzie, Jamie Chadwick, Billy Monger, and Lawrence Barretto will join them throughout the year.

F1 has announced various rights extensions in the off-season overseas, including in Mexico and Belgium, where the sport will continue to air on FOX Sports Mexico and Play Sports.

Over in Asia, the sport will continue its long-standing partnership with Fuji Television in Japan, with their agreement with DAZN also continuing in the market until the end of 2025.

Fans in India will have access to live action via F1’s over-the-top service for the first time, while beIN SPORTS will cover F1 in ten territories across Asia, including Singapore, Malaysia, and Indonesia.

Elsewhere in the motor sport spectrum, 2023 sees the end of the BT Sport brand in the UK. While MotoGP remains live on BT Sport, and both World Superbikes and British Superbikes remain on Eurosport, all three will become part of the TNT Sports brand in the medium term.

TNT Sports becomes the new name for BT Sport from July, with Eurosport merging into the brand “sometime into the future” following the announcement of a joint venture between BT Group and Warner Bros. Discovery last year.

The F1 Academy series launches in April; however, details of broadcasting arrangements are unknown as of writing.

Plenty on offer in the podcasting world

The BBC remains F1’s radio rights holders in the UK, with every race airing across either BBC Radio 5 Live, BBC Radio 5 Live Sports Extra or the BBC Sport website.

Thursday 2nd March

20:00 to 21:00 – Season Preview (BBC Radio 5 Live)Friday 3rd March

11:25 to 12:45 – Practice 1 (BBC Radio 5 Live Sports Extra)

13:30 to 14:00 – Bahrain Grand Prix Preview (BBC Radio 5 Live)

14:55 to 16:15 – Practice 2 (BBC Radio 5 Live Sports Extra)Saturday 4th March

11:25 to 12:45 – Practice 3 (BBC Radio 5 Live Sports Extra)

14:55 to 16:15 – Qualifying (BBC Radio 5 Live Sports Extra)Sunday 5th March

The full UK radio schedule for the 2023 Bahrain Grand Prix.

14:45 to 17:30 – Race (BBC Radio 5 Live Sports Extra)

Rosanna Tennant leads their offering for the start of 2023 season following Jennie Gow’s serious stroke at the end of December. Writing on Twitter last week, Gow said “I’m gutted not to be well enough to return to the paddock and to bring you all the excitement.”

“My recovery is progressing well – considering eight weeks ago I wasn’t able to move fully or speak at all!” Motorsport Broadcasting wishes Gow well on her recovery.

Jack Nicholls and Harry Benjamin will share the lead commentator microphone on 5 Live, alongside a roster of talent including Formula E driver Sam Bird, Chadwick and Palmer. Supplementing the BBC’s main race offering will be their Chequered Flag podcast, presented by the 5 Live team.

Joining 5 Live in the motor sport space this year is talkSPORT, who have launched a one-hour weekly show in collaboration with Formula E.

Presented by Jon Jackson, On Track airs on talkSPORT 2 on Tuesday afternoons, focusing not only on the electric series, but also on other championships, including F1 and MotoGP.

Where original audio and podcast content is concerned, the BBC’s and talkSPORT’s offering is only the beginning in a vast landscape this season.

Sky have launched their own podcast, with new episodes premiering every Tuesday. Presented by Matt Baker, The Sky Sports F1 Podcast replaces Any Driven Monday, which will not return to Sky’s YouTube channel after a single season on air.

The Race Media have refreshed their WTF1 brand in the winter break, with two of the brand’s key players, Tom Bellingham and Matt Gallagher moving to pastures new.

The two have been largely responsible for the brand’s growth over the past decade, taking the brand from start-up to major player in the motor sport landscape. Instead, the two opted to create P1 with Matt & Tommy, a brand that they have full creative control over.

Content creators Andre Harrison, Hannah Atkinson, Ciaran Oakes, and Charley Williams have joined WTF1 ahead of the new season, with Jack Nicholls’ hosting WTF1’s s flagship Internet’s Best Reactions YouTube series.

“I believe the new team we have assembled gives us the best opportunity to keep the brand relevant and cater to the next generation of Formula 1 fans,” said The Race Media founder and COO Andrew van de Burgt.

Another new addition to the podcasting world this season is The Fast and The Curious, with a few recognisable faces to a non-F1 audience. BBC Radio 1 presenter Greg James hosts the podcast alongside Betty Glover and Christian Hewgill.

The show’s creators says that the podcast is “die-hard fans as well as those who are curious to learn more about the fascinating F1 world and the characters that inhabit it,” with guests in the opening episodes including Mercedes driver George Russell and Lewis Hamilton, and new Williams rookie Logan Sergeant.

And, if that was not enough, ex-Sky F1 pundit Herbert and Monger have launched the Lift the Lid podcast, while Whisper have launched a podcast with Coulthard and Eddie Jordan.

Lift the Lid has been “brought together through a love of F1 and their joint experience of life-changing crashes,” the two “join forces to give a unique drivers-eye-view on all the hottest topics from up and down the F1 grid each week!”

The Athletic joins the F1 media pack

A big addition on the writing front for 2023 is The Athletic, who have snapped up journalists Luke Smith from Autosport and Madeline Coleman from Sports Illustrated to kick start their coverage.

Introducing their F1 offering, The Athletic’s Managing Editor for F1, Alex Davies said “Our coverage will build on The Athletic’s mission of going beyond the chyron delivering scores and stats to the bottom of your TV screen.”

“From each racetrack around the world, we’ll dive deep into the personalities, technology, strategy, business, politics, culture and miscellanea of F1,” Davies added.

“Whether you’re new to F1 or a Serious Fan, we’ll get you up to speed by telling you not just who won, but how and what it means. Not just fighting words, but the roots of the rivalries. Not just how to tune into a race, but how to watch it like a pro.”

Davies highlights Drive to Survive as a factor in The Athletic beginning its F1 coverage, which has already been recommissioned for season six covering the 2023 season.

Autosport and The Race remain on the starting grid both in the written media and podcasting world, the latter now firmly embedded into the paddock and heading into their fourth season covering the sport.

Other faces to follow across social media in 2023 include Auto Motor und Sport’s Tobi Grüner and technical expert Albert Fabrega, the two breaking stories before the UK contingent of journalists.

AMuS’s most recent exclusive concerns the future of the AlphaTauri team, with owners Red Bull considering to put the team up for sale, a suggestion later denied by the team.

If journalists or broadcasters are not your thing, there is the other option of going DTT: direct-to-team. Expect plenty of content across the ten teams’ and 20 drivers social media channels this year, bringing fans closer to the action.

While Drive to Survive and broadcasters, such as Sky, aim to give all the grid ample coverage, some teams receive the short straw last season.

A tweet posted a few weeks ago by Williams suggested that they were releasing a behind the scenes documentary series focusing on their 2022 season, however Williams have since deleted the tweet.

Whether it is Red Bull’s Behind the Charge series or McLaren’s Unboxed, there is plenty of content to engage fans throughout 2023 across the different platforms.

Are Red Bull set to dominate 2023?

Audience figures stayed stable in 2022, with F1’s commercial rights holder Liberty Media reporting a cumulative audience of 1.54 billion viewers, resulting in an average per race worldwide of 70 million viewers.

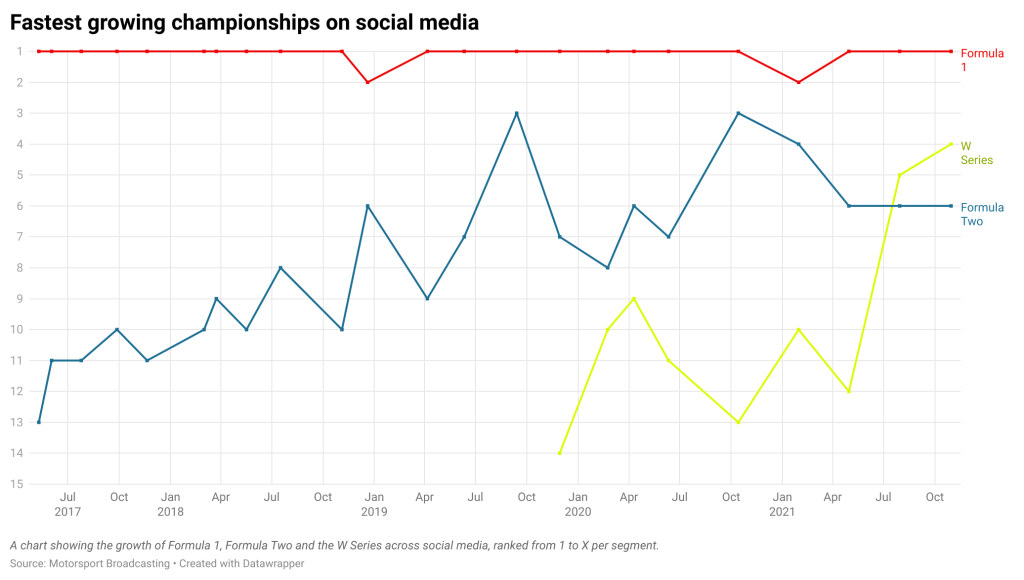

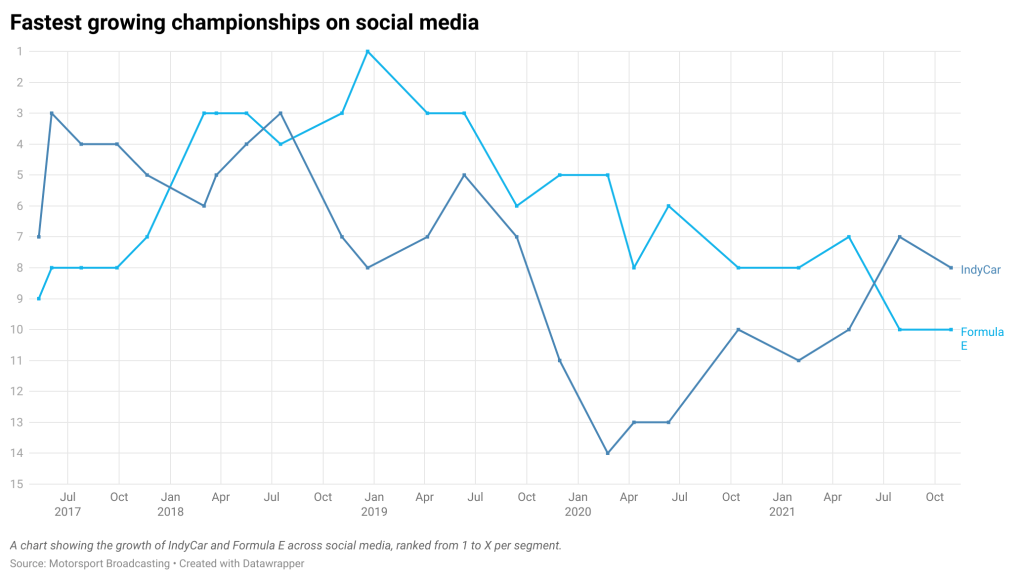

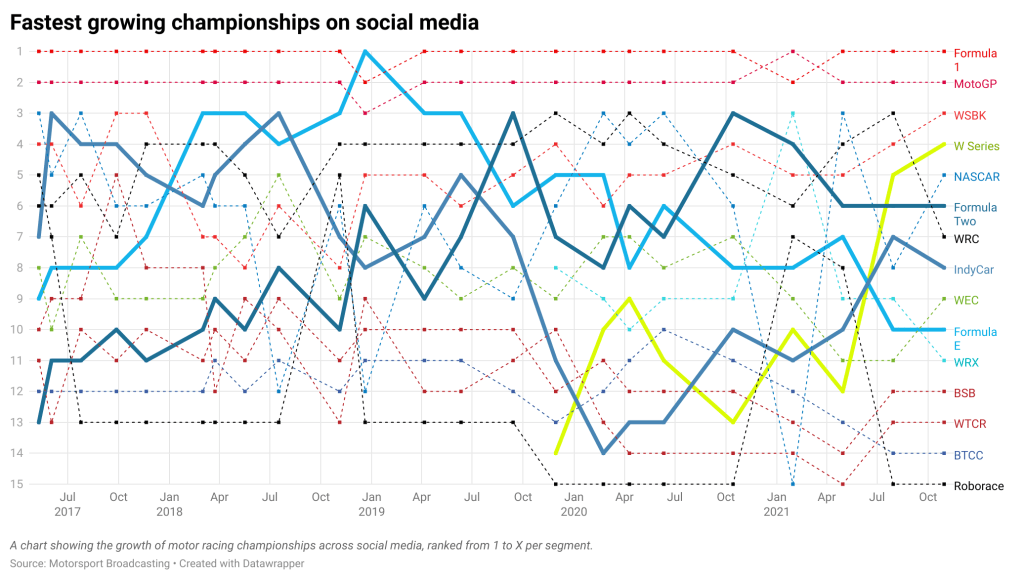

Other metrics reported by Liberty indicate that F1 remains on the rise, with strong attendances following the COVID-19 pandemic and a 23% rise in the number of social media followers.

Early signs from testing suggest that Red Bull are the outfit to beat this year, as Max Verstappen looks to clinch his third consecutive Drivers’ Championship. Nevertheless, F1 will be hoping for a closer championship battle this year to keep the audience engaged through the 23 races.

Can Red Bull remain at the front, or will Ferrari, Mercedes and even Aston Martin pose a threat this season? Will it be Verstappen celebrating at the end of 2023, or are we looking at Verstappen vs Hamilton, round 2?

In the words of Sky Sports: enjoy the ride.

If you enjoyed this article, consider contributing to the running costs of Motorsport Broadcasting by donating via PayPal. If you wish to reproduce the contents of this article in any form, please contact Motorsport Broadcasting in the first instance.

Last updated on March 3rd at 20:20 to add details about Channel 4’s on-air team, Sky’s multi-screen options, a minor tweak to Sky’s schedule and a new podcast from Whisper.